dallas texas local sales tax rate

The base state sales tax rate in Texas is 625. This includes the rates on the state county city and special levels.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

The Texas state sales tax rate is currently.

. Taxes Home Texas Taxes. Within Dallas there are around 80 zip codes with the most populous zip code being 75217. The Dallas Texas sales tax is 625 the same as the Texas state sales tax.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Sales Tax State Local Sales Tax on Food. 4 rows Dallas collects the maximum legal local sales tax.

In 2015 the Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three most commonly used web browsers on their websites. Texas Comptroller of Public Accounts. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

The top 12 city sales and. The minimum combined 2022 sales tax rate for Dallas Texas is. 33 rows Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum.

How much are taxes in Dallas TX. Sales and use tax rates in the Houston region vary by city. Denton TX Sales Tax Rate.

Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Dallas sales tax rate is. An item is sold for 20 and the total tax rate is 825 percent 625 percent state tax 2 percent city tax.

Find your Texas combined state and local tax rate. Terminate or Reinstate a Business. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825.

Sales Tax Permit Application. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. What is the sales tax on 100 in Texas.

Calculating Sales Tax For example if someone were to purchase a necklace for 100 in an area of Texas that does not charge a local tax the calculation would be 625 multiplied by 100 for a sales. Local Code Local. You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables.

The sales tax rate does not vary based on zip code. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. This is the total of state county and city sales tax rates.

Dallas TX Sales Tax Rate. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

2022 Tax Rates Estimated 2021 Tax Rates. The Dallas County sales tax rate is. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

To review the rules in. To make matters worse rates in most major cities reach this limit. Has impacted many state nexus laws and sales tax collection requirements.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The 2018 United States Supreme Court decision in South Dakota v. Dallas is located within Dallas County Texas.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The average cumulative sales tax rate in Dallas Texas is 825. Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community.

The Texas sales tax rate is currently. The County sales tax rate is. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose a sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

The 825 sales tax rate in Dallas. 214 653-7811 Fax. Real property tax on median home.

City sales and use tax codes and rates.

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

2021 2022 Tax Information Euless Tx

Texas Sales Tax Map By County 2022

Top 10 Metros With The Lowest Property Tax Rates Attom

Sales Tax Chart 8 25 Google Search Sales Tax Chart Otosection

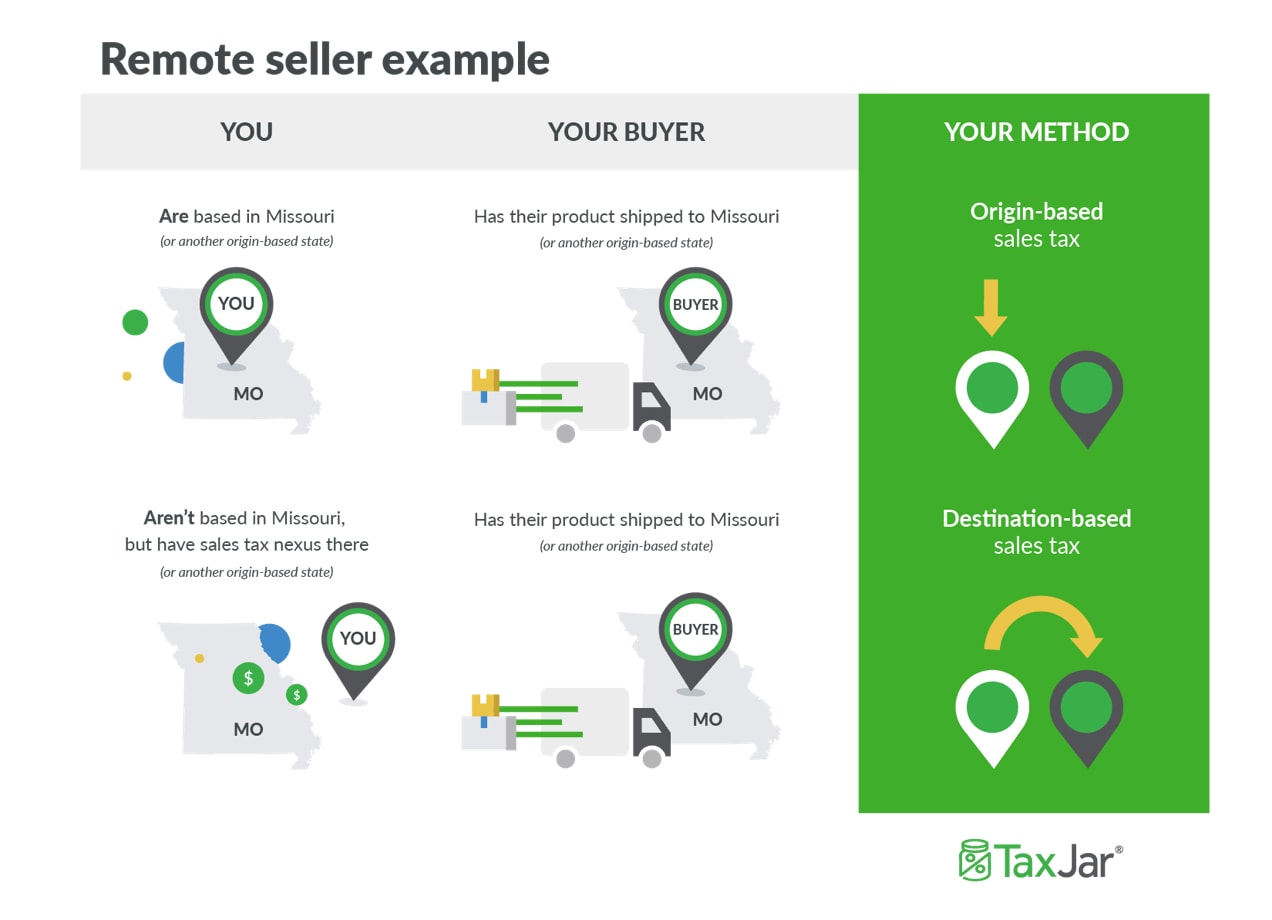

How To Charge Your Customers The Correct Sales Tax Rates

Tax Rates Richardson Economic Development Partnership

Worksheet For Completing The Sales And Use Tax Return Form 01 117

Texas Sales Tax And Llc Business Taxes Incfile Com

How To Charge Your Customers The Correct Sales Tax Rates

States Sales Taxes On Software Tax Foundation

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Chart 8 25 Google Search Sales Tax Chart Otosection

Taxes Celina Tx Life Connected

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Texas Sales Tax Guide And Calculator 2022 Taxjar

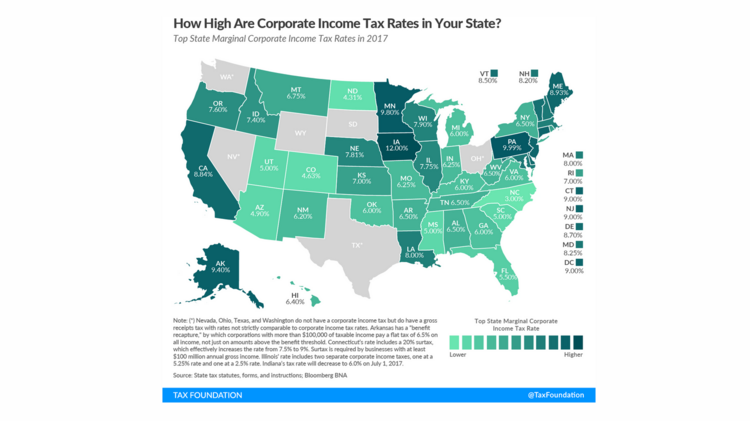

Colorado Goes Easy On Corporate Income Taxes Denver Business Journal